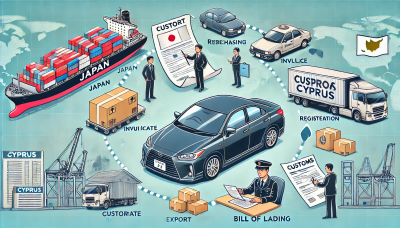

Importing a car from Japan to Cyprus can be a rewarding experience, giving you access to high-quality vehicles at competitive prices. This guide will walk you through each step of the process, from understanding import regulations to registering your car in Cyprus.

Japanese cars are renowned for their reliability, advanced technology, and fuel efficiency. Importing from Japan can also be cost-effective, with a wide range of vehicles available at various price points.

Before you start the import process, it’s crucial to understand Cyprus's import regulations. The primary rule is that cars must be no older than five years from the date of first registration. Additionally, the vehicle must comply with Cyprus emissions standards.

To import a car into Cyprus, ensure that it meets the following criteria:

The car must be within five years of its first registration date.

It must comply with Cyprus emissions and safety standards.

The vehicle must have an original export certificate translated into English.

Research is key when importing a car. Look for popular models that are known for their reliability and resale value. TokyoCarZ.com offers extensive listings and details on Japanese cars.

Before purchasing, have the car inspected to ensure it meets your expectations. TokyoCarZ provides detailed inspection reports. Payment methods typically include bank transfers or Wise, PayPal services.

You'll need the following documents:

Original Export Certificate: This proves the car's export from Japan and must be translated into English.

Invoice: Required for calculating and paying taxes and duties.

Bill of Lading: Necessary for collecting the car from the shipping company.

The export certificate is crucial for the registration process in Cyprus. Ensure it is accurately translated into English by a certified translator.

The invoice details the purchase price, which is used to calculate import taxes and duties. Currently, the import duty is 10% of the car’s value, and VAT is 19%.

The bill of lading acts as a receipt and contract between the shipper and the shipping company. It is essential for collecting your car once it arrives in Cyprus.

Common shipping methods include Roll-on/Roll-off (RoRo) and container shipping. RoRo is generally cheaper, while container shipping offers more protection. Shipping can take 4-8 weeks depending on the method.

Upon arrival, your car will go through customs clearance. Present all necessary documents, including the export certificate, invoice, and bill of lading. Pay any applicable taxes and duties.

To register your car, submit the translated export certificate, customs clearance documents, and proof of insurance to the Road Transport Department. Registration fees and road tax will apply.

Taxes and duties include a 10% import duty and 19% VAT. These are calculated based on the car’s CIF (Cost, Insurance, Freight) value.

Ensure your car meets Cyprus emissions standards, which might require modifications or additional certifications.

You’ll need to insure your car before it can be registered. Comprehensive coverage is recommended to protect your investment.

Importing for personal use generally involves fewer regulations compared to importing for resale. However, both require adherence to the same import criteria and documentation.

Regular maintenance is crucial for longevity. Use reputable service centers familiar with Japanese cars, and source parts from authorized dealers.

What are the age restrictions for importing a car to Cyprus?

Cars must be no older than five years from the date of first registration.

What documents are required for importing a car to Cyprus?

You need the original export certificate (translated into English), the invoice, and the bill of lading.

How are taxes and duties calculated for imported cars in Cyprus?

Taxes and duties include a 10% import duty and 19% VAT, calculated based on the car’s CIF value.